The Internal Revenue Service (IRS) is on a hiring spree, and they are not just looking for tax collectors! In addition to beefing up the enforcement unit, the agency is hiring thousands of federal employees in diverse career fields. The IRS employs more than 100,000 people around the world.

They are also modernizing antiquated technology systems that will improve the IRS’s ability to collect taxes and support government operations. This will significantly enhance the mission of the IRS as the agency is the steward of U.S. economic and financial systems and a major and influential leader in today’s global economy.

Do you have experience, education, or training in information technology, tax law, economics, human resources? What about program management, investigations, legal assisting, paralegal, inventory management, and even equipment operations? Are you bi-lingual? Your talent is needed, too.

A new law signed by President Biden on August 16, 2022, provides the IRS with nearly $80 Billion. Yes, that’s Billion with a B. This additional money is for hiring tens of thousands of employees over the next decade.

Perhaps this is your time to land a rewarding federal job or federal promotion!

Party politics aside, if you are seeking a federal position, this might be your opportunity. This could be the time for you to make a significant impact in your career through public service.

This is one of the largest hiring sprees in the Federal government since Congress federalized airport security following 9/11. The Transportation Security Administration hired nearly 50,000 airport security screeners, and in fact, is also currently hiring.

Until recently, the IRS was unable to replace retiring employees due to years of underfunding.

According to the IRS, the Service had 117,000 employees in 1992—38,000 more than today! Back then, the agency was dealing with fewer taxpayers—the U.S. population has grown almost 30% since 1992. In addition, the IRS expects nearly 50,000 of its current work force to retire in the next five years. Many of the employee retirements came in the compliance and enforcement arena. These are the people who audit the complex tax returns of corporations and wealthy individuals. And, the IRS was unable to replace them, resulting in less tax revenue collected and increasing the Tax Gap.

In short, the Tax Gap is the difference between true tax liability for a given tax year and the amount that is paid on time.

Good news: Shorter wait times.

After seven years of reduced budgets, Congress began increasing the IRS’s budget beginning in 2019. This was due in part to taxpayer complaints about long wait times when calling the IRS’s taxpayer assistance lines. It was also due to reductions in the number and staffing of regional Taxpayer Assistance Centers.

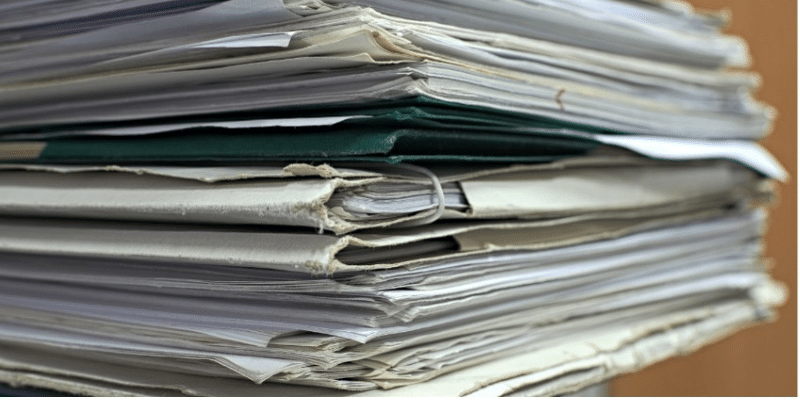

The IRS was also having trouble hiring people to open and scan tax returns filed on paper and taxpayer correspondence.

And, the entry level salary for Tax Examiners, Mail & File Clerks, and Data Transcribers was about $14 per hour. That was less than Amazon and big box stores were offering. Moreover, the Federal hiring process can be slow. That is, unless you get familiar with our strategy of how to write your resume to speak to each of the gatekeepers!

Enter: Worldwide pandemic.

Then came the COVID-19 pandemic, which hit in the middle of the 2020 tax filing season. The IRS, like other Federal agencies, sent employees home while it tried to figure out how to quickly expand the Service’s ability to serve taxpayers remotely. It took a bit of time, but the IRS was able to equip many of its employees with computers and software that allowed them to work remotely.

However, millions of paper tax returns and letters were piling up in the IRS’s big service centers in Austin, Texas; Kansas City, Missouri; and Ogden, Utah. The IRS eventually mastered social distancing for its service center employees.

All too soon, the 2021 Filing Season began, adding to the stacks of mail. Then came the 2022 Filing Season and in January 2022, President Biden issued an executive order. This executive order set the minimum wage to $15 an hour for Federal employees.

Approval for Direct Hiring = Faster hiring.

Under strong criticism from Congress, the IRS got approval from the Office of Management in March of 2022 to begin hiring 10,000 new employees using an expedited hiring process known as direct hire. In June of 2022, the IRS announced it was looking to hire more than 4,000 contact representative positions at several IRS offices nationwide.

A contact representative provides administrative and technical assistance to individuals and businesses primarily over the phone, through written correspondence or in person. The IRS continues to hold both in-person and virtual job fairs. More information can be found on the IRS website.

Federal government agency, IRS, gets much-needed funding for hiring new agents.

In March 2022, President Biden announced a plan to dramatically increase spending for several domestic programs. To help pay for the legislation called Build Back Better, the President proposed giving the IRS $80 Billion to improve its ability to gather taxes from wealthy individuals and corporations.

The Build Better Back legislation cleared the House but stagnated in the Senate until July 2022. At this time, Senator Joe Manchin, D-WV and Senate Majority Leader Chuck Schumer, D-NY announced a new bill, titled Inflation Reduction Act. The new proposal focused on climate change and included nearly $80 Billion for the IRS.

Republicans in both houses of Congress opposed giving the IRS that much money. They warned that the IRS was would hire 87,000 armed agents who were going to audit the taxes of middle class taxpayers. Democrats and the Administration stated that no taxpayers earning less than $400,000 would be audited.

IRS Commissioner Chuck Rettig addressed both issues in a column posted on Yahoo Finance: “The majority of new hires the IRS makes will be those who answer the phones, work on processing individual tax returns, or go after high-end taxpayers or corporations who are avoiding their taxes,” the Commissioner wrote. “Less than 1% of new hires will be in our IRS Criminal Investigation (IRS-CI) area, which currently has a total of about 2,100 special agents and is currently hiring about 300 more.”

While more than $45 Billion of the Inflation Reduction Act is earmarked for compliance and enforcement personnel, the IRS is currently prioritizing the hiring of people to improve customer service, according to the Wall Street Journal. The IRS held job fairs earlier this year to hire people to help clear the paper backlog and plans to hire customer service representatives to assist taxpayers trying to obtain assistance via telephone.

So…who is the IRS hiring?

The IRS is not just looking for bean counters. They need people with a background in customer service, information technology, economics, human resources, tax law, program management, investigations, legal, inventory management, and equipment operators.

The IRS website has a nifty app to help recent college graduates, and really anyone, identify potential career paths.

Your efforts could help make America stronger in supporting the nation’s most vital programs from Homeland Security to Social Security to America’s defense—as well as programs like parklands, forest, roads, bridges, libraries, schools, museums, and so much more.

The website also features videos of IRS employees talking about their jobs:

- Revenue Agent

- Revenue Officer

- Information Technology

- Taxpayer Advocate

- Data Transcriber

- Contact Representative

- General Engineer

The best website to find open positions at the IRS and other federal agencies at USAJOBS.

But before you apply to IRS, or any other federal position, be sure your federal resume conveys your value at the highest level so you can be considered for the job that you will qualify for—and so you can get paid at the highest level possible.

MAGNETIC TIP: Don’t submit a generic resume without focus and expect the gatekeepers to figure out how you fit in. Make it EASY to get HIRED!

If you’re interested in working for the IRS, or any other federal agency, we can help you identify the best career path and how to pre-qualify for federal jobs so you won’t waste your valuable time (and money).

You can count on us to strategically write your federal resume, cover letters, and any narratives to capture the attention of the gatekeepers, including USAJOBS—the first gatekeeper, so you can land interviews and job offers!

To learn more about how tens of thousands of our clients have landed jobs and promotions from our federal career coaching, federal résumé writing services, USAJOBS strategies, and much more, let’s have a quick chat!

We will do a thorough review of your resume, job announcement, and ensure you are on the right path to success.

We look forward to helping you land your dream job…faster!

- 🚫 CAUTION: Bad Advice #3 in our Top 10 Worst Federal Resume Advice! 🚫 - July 22, 2024

- Lean On Me: A Little Tribute to Family & Friends - July 21, 2024

- 🚨 Be careful of Bad Advice #4 in our Top 10 Worst Federal Resume Advice series! 🚨 - July 15, 2024